We all know the feeling of Orient-Express taste on an Spirit Airline budget. You want to take that dream honeymoon or long-awaited family vacation, but you don’t know how to start saving—and the price tags seem daunting. We sought some answers from budget-living expert Melissa Massello, founder of ShoestringMag.com. From setting budget goals to finding alternative sources of cash, there are countless ways to make your dream vacation a reality. Here are seven helpful tips for budgeting for that bucket-list vacation.

How to Save for a Vacation

Image Gallery

Set a Price Point

This first step can be the most difficult part of trip planning, because many people (according to Gallup, a full two-thirds of the adult population!) don't keep or create a household budget. But you have to start somewhere, and you should never plan a trip without money in mind.

Closely and frankly examine your finances as well as your travel partner's. Decide how much you can realistically save in a predetermined period of time. For instance, if you know you can save $50 per week, you'll also know that you'll have $2,600 toward your vacation in one year's time. If you can stretch that to $100 per week, you'll have more than $5,000. Once you have a number on paper, then you can decide on a savings plan. If you discover that your once-in-a-lifetime trip is going to cost twice what you can save, you'll need to adjust your budget or your timeline.

Set a Price Point

This first step can be the most difficult part of trip planning, because many people (according to Gallup, a full two-thirds of the adult population!) don't keep or create a household budget. But you have to start somewhere, and you should never plan a trip without money in mind.

Closely and frankly examine your finances as well as your travel partner's. Decide how much you can realistically save in a predetermined period of time. For instance, if you know you can save $50 per week, you'll also know that you'll have $2,600 toward your vacation in one year's time. If you can stretch that to $100 per week, you'll have more than $5,000. Once you have a number on paper, then you can decide on a savings plan. If you discover that your once-in-a-lifetime trip is going to cost twice what you can save, you'll need to adjust your budget or your timeline.

Research Your Destination

You won't know what you'll need in your wallet until you do the research. It's worthwhile to look up everything you can, from the average cab fare to whether tipping is customary. This way, nothing will catch you by surprise. Ask friends and family who have traveled to your destination about the costs they incurred, including accommodations, airfare, and activities. Travel guides, official tourism websites, and consumer-travel resources (like SmarterTravel and Lonely Planet) will also give you a general estimate of what you'll need.

Additionally, Massello recommends accounting for extra travel costs, like health insurance, passport renewals, cell phone roaming charges, baggage fees, and other logistical expenses: "It might seem like a lot, but the best part about overestimating your budget is that if you find really great deals in any category, you can then use the 'extra' money for fun stuff and will actually be able to fully relax on vacation—without financial worry."

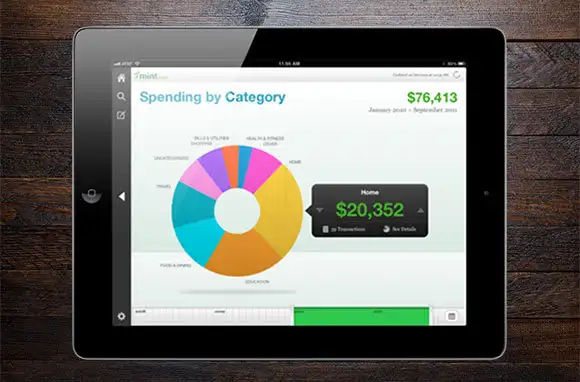

Use Budget Tools

If you're not currently a budget keeper, technology can help you become one. The smartphone app Mint tracks expenses, manages account balances, and even gently reminds you when bills come due. Every week, Mint sends a snapshot of your spending, which will keep you on track for large, long-term expenses. (It's also especially wallet-friendly, being free to download.) Massello also recommends the free budget templates from Budgets Are Sexy, which can easily be exported and shared on Google Docs or Excel. If you know you're prone to blowing your budget on groceries and expensive meals, the blog And Then We Saved has cute, simple templates for thriftily planning out a week's meals.

Look for Alternative Sources of Income

You may be sitting on a pile of cash, completely unaware. Hidden sources of income can be worthwhile ways to reach your vacation goals. Look into old savings bonds, stagnant stocks, or even unused valuables as potential budget boosters. (Even wedding gowns can be sold via sites like Tradesy and Once Wed.) "Get creative about some sort of 'side hustle' to bring in extra cash," says Massello. "Are you a skilled crafter or thrifter? Maybe you could sell handmade or vintage items on Etsy or eBay." And when all else fails, your attic may hold some serious value: "Recruit your friends, partner, or family to help you host a massive yard sale to de-clutter your house while donating to your vacation fund." Taking a trip with the kids? Get them involved by babysitting, mowing lawns, or raking leaves for some vacation pocket change.

Save Every Single Day

"Most of us are hemorrhaging money in our weekly expenses and we don't even know it," says Massello. We drop cash on things like $24 fitness classes and $5 lattes without a second thought—but all of these purchases take away from our overall trip savings. Being mindful about your everyday purchases is the first step; downloading a budgeting app or frequently checking your bank balance will show you where all of your money is going.

After all, Massello points out, "Once you see, itemized and in pie-chart format, exactly how much you're spending on groceries or gym memberships or manicures or happy hours, it's easier to identify ways to trim the fat." Then you can plan smart workarounds. Instead of the $5 latte, make good, old-fashioned drip coffee at home. Skip the froufrou $24 fitness class and instead follow Massello's advice to "find a free community event and put that money in savings." And instead of mindlessly swiping your debit card, withdraw a predetermined amount of cash every Sunday and use that for your daily purchases. Remember that for every dinner in, you are one step (and several dollars) closer to your vacation.

Have Fun on a Budget

While saving up your pennies for your dream vacation, you'll still need entertainment and distraction. Cultural enrichment—from bar covers to movie admissions—doesn't always come cheap, but being thrifty doesn't have to be boring (nor does it mean you have to stay inside for weeks on end). "There are literally hundreds if not thousands of free nightlife events in every major city, every night of the week, that are as much if not more fun than those things you were going to spend money on," says Massello. Check your area for free events (a great source is alternative weekly papers). Libraries, universities, concert halls, and YMCAs are all prime places to find fun, free entertainment. Many wine shops do free tastings, and local music and dance schools often have free students' showcases.

Stay Inspired

During the long savings slog, it may seem like your dream destination is about as tangible as Shangri-La. So keep yourself motivated. Massello recommends planning a "staycation" inspired by your dream trip. For instance, if you're finally taking that bucket-list trip to Argentina, take a Spanish-language or tango class, or try cooking an authentic Argentinean meal (flank steak with chimichurri, anyone?). Planning a beach trip? "Apps like GymPact are a great way to motivate you to stay in shape for your trip and save for it at the same time," says Massello.

Social media sites can also serve as great inspirational tools: On Pinterest, pin beautiful photos of your destination and make possible itineraries of must-see sights. Follow your destination's local tourism board on Twitter; tourism boards often tweet photos and post informative facts that are as useful as they are motivating.

Finally, change your smartphone's wallpaper to an evocative image of your soon-to-be getaway. This can be especially helpful if you use your phone to buy Starbucks coffee, because stunning sunset photos of Thailand are the best soy-mocha deterrents.

Readers, what are your tips for budgeting for a dream vacation?

More from SmarterTravel:

- 10 Insanely Affordable Spring Destinations for 2017

- 10 Beaches That Should Be on Your Bucket List

- Best Free Airline Amenities 2017

Editor’s note: This story was originally published in 2014. It has been updated to reflect the most current information.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Related

Top Fares From

Today's Top Travel Deals

Brought to you by ShermansTravel

France: 8-Night Paris, Avignon & Nice...

Infinity Worldwide Vacations

vacation

$2880+

vacation

$2880+

Poconos: 3 Nts in Garden of...

ResortsAndLodges.com

hotel

$305+

hotel

$305+

7-Nt Canada & New England Cruise,...

Princess Cruises

cruise

$839+

cruise

$839+